stock options tax calculator usa

Ad A range of options trade data alerts and visualizations a single web-based tool. Ad With over 40 years experience in options trading we have a robust set of tools.

Understanding How The Stock Options Tax Works Smartasset

Receiving options for your companys stock can be an incredible benefit.

. In our continuing example your theoretical gain is. Ad For Private and Public Companies Who Want Equity Plans Done Right. On this page is a non-qualified stock option or NSO calculator.

The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. Lowest costs for low high frequency options traders. Nonqualified Stock Options NSOs are common at both start-ups and well established companies.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. If your options were issued and certain other.

Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. On this page is an Incentive Stock Options or ISO calculator. By admin Posted on December 24 2021.

Web-based platforms to quickly analyze options trading activity and identify opportunities. There are two types of taxes you need to keep in mind when exercising options. On this page is a non-qualified stock option or NSO calculator.

Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration. How much are your stock options worth. Ad Objective-Based Portfolio Construction is Key in Uncertain Times.

This permalink creates a unique url for this online calculator with your saved information. Build Your Future With A Firm That Has 85 Years Of Investing Experience. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Please enter your option information below to see your potential savings. Fidelity Has the Tools Education Experience To Enhance Your Business.

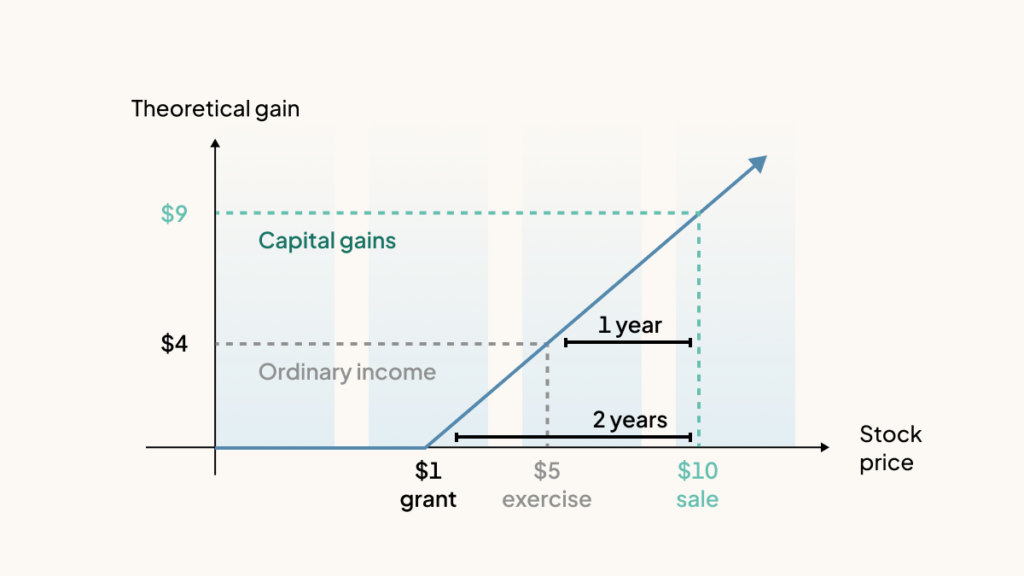

Learn How We Can Help. Even after a few years of moderate growth stock options can produce a handsome return. When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock.

Even taxpayers in the top income tax bracket pay long-term capital gains rates. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Ad An easy way to get started with online trading.

Section 1256 options are always taxed as follows. 60 of the gain or loss is taxed at the long-term capital tax rates. Ordinary income tax and capital gains tax.

The taxable benefit is the difference between the price you paid for the shares the strike price and their value on the date of exercise. Nonqualified Stock Option NSO Tax Calculator. Non Qualified Stock Options Calculator.

40 of the gain or loss is taxed at the short-term capital tax rates. Ad For Private and Public Companies Who Want Equity Plans Done Right. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term.

See how this trading course helps small investors earns Extra Income. This is an online and usually free calculator. The Stock Option Plan specifies the total number of shares in the option pool.

This is ordinary wage. The Stock Option Plan specifies the employees or class of employees eligible to receive options. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options.

Fidelity Has the Tools Education Experience To Enhance Your Business. Click to follow the link and save it to your Favorites so.

Printable Loan Payment Schedule Template Schedule Template Loan Payoff Student Loan Payment

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

High Angle View Of A Person Stacking Coins Near House On Wooden Desk Property Tax Conceptperson Stacking Coins H Photography Tutorials Shutterstock High Angle

Bridge Loans Bridge Loan Loan Tax Refund

About Ebsa United States Department Of Labor Retirement Calculator Retirement Calculator Department Financial Planning

Digital Currency Manager Accounting Appointment Card Zazzle Appointment Cards Management Business Card Size

How Stock Options Are Taxed Carta

Trucking Spreadsheet Spreadsheet Template Spreadsheet Study Skills

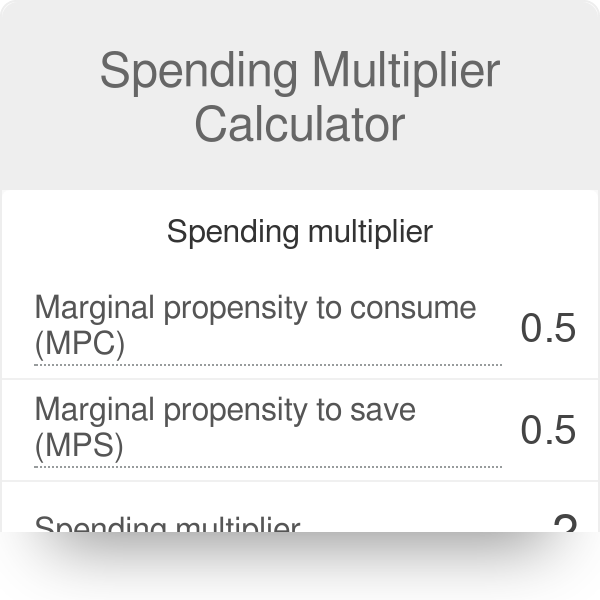

Spending Multiplier Calculator Formula

Rsu Calculator Projecting Your Grant S Future Value

Roth Ira Contribution Limits Medicare Life Health 2019 2020 Rules Roth Ira Roth Ira Contributions Ira

What Are The Best Cryptocurrencies For Swing Trading In 2022 Swing Trading Day Trading Short Term Trading

Forex Trading Strategies Day Trading Stocks Trading Pins Pin Trading Day Trading For Beginners Trading Opt Forex Trading Forex Trading Quotes Technical Trading

State By State Guide To Taxes On Retirees Retirement Retirement Income Tax

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Benefits Of Buying Private Health Insurance From Insurance Agency In Canada Group Life Insurance Life Insurance Companies Life Insurance Policy

Business Accounting Stock Photos Ad Accounting Business Photos Stock Accounting Services Accounting Jobs Accounting